If you’ve ever wondered how to make money trading earnings on stocks, you may be wondering what factors influence their prices. Earnings are often a major factor in the price movement, but the relationship between the actual results and the resulting price move is not always straightforward. For example, while Walmart’s earnings were well above analysts’ expectations, the company’s shares were not immediately affected by its news. This is because analysts focus on the firm’s future earnings rather than its current results. However, analysts’ attention to future earnings is often more influential than the resulting price movement.

Before making trades during earnings release, you should analyze a company’s reports before placing your trades. You can find out the exact time the report is released by visiting the company’s website. You can also review previous reports and get the full report when it comes out. This way, you can take advantage of the earnings release to make profits. The earnings report is just as important as any other market event. Traders should remain calm and patient during earnings reports especially trading on hsi index live, as this will help minimize the risks associated with trading earnings on stocks.

If you’re new to trading earnings on stocks, you’ll want to keep a close eye on company news and the results of its earnings report. The earnings report may reveal a lot about the fundamentals of a company, and the market’s reaction to that news will influence expectations for the stock’s performance. You can take advantage of these developments by entering trades at the right time. This way, you’ll be able to maximize your profits while minimizing your risk.

Another trend you should monitor is the rise and fall of commodities and natural gas prices. During the outbreak of the coronavirus, commodities and paper products spiked, which affected many industries. In this case, trading earnings on stocks jumped as demand for cleaning supplies and paper products increased. Traders should look for these trends. Not only do these trends influence your overall macroeconomic strategy, but they also act as a tangible threat to the index itself.

If you’re a stock trader, earning season is the best time to invest. Most public companies release earnings reports quarterly. After these releases, the prices of stock can jump by tens of percent. This news can impact the entire financial market, allowing you to trade during a period of high volatility. This is an opportunity not to be missed. You’ll be able to benefit from large moves on the stock market.

Another strategy for trading earnings is straddle options. A straddle involves buying both a call and a put option. Both have the same expiration date. Traders who believe that a stock will move in one direction but fall in another may want to use a straddle. With this strategy, you’ll be able to profit from both price changes. If you have a large number of stocks that move in one direction, this strategy could be the best for you.

Another way to make money trading earnings on stocks is to learn how to analyze economic data. The economy moves the market, and the data behind the numbers will help you make wise decisions about which trades to make. Luke Lloyd, a wealth advisor and investment strategist at Strategic Wealth Partners, says, “Investors are not so much concerned with the price movement as they are with how the company’s fundamentals perform. They’re more concerned with the future growth of the company.

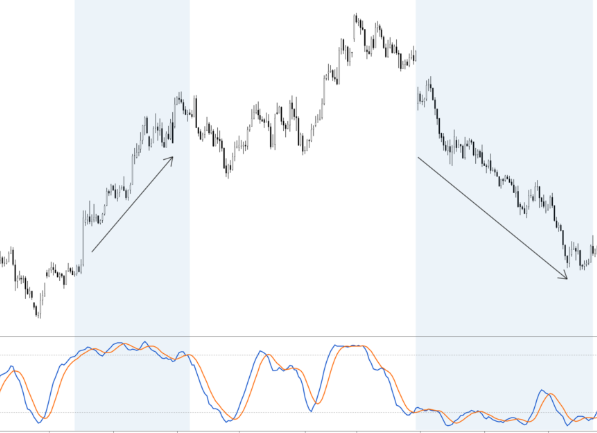

A good indicator of the earnings cycle is implied volatility. If a company reports an earnings report and the stock price immediately drops, traders will buy options to speculate on that news. The options that are bought at this time usually have higher implied volatility than those that are bought after the announcement. The volatility will decrease quickly after the earnings announcement because the uncertainty is reduced. It is important to watch for these volatility trends, because they can affect the price of options and affect a trader’s profit.

EPS is another factor to watch in the stock market. Earnings per share are the earnings of a company. Earnings per share are the measure of profitability and attract investors’ attention. Companies need to report quarterly earnings to shareholders, and the higher the EPS, the higher its stock price. However, earnings per share is only one metric. There are other important factors, such as dividends, to consider when trading earnings on stocks.